Highlights Extended Furnishing Deadline The deadline for furnishing 2020 statements to individuals has been extended. However, the deadline for filing with the IRS remains the same. Relief From Penalties Notice

Plan Amendments Employers can retroactively adopt plan amendments incorporating these provisions. Specific requirements must be met: The plan must be operated consistently with the amendment terms until the amendment is

Highlights Non-grandfathered group health plans and insurance issuers must cover coronavirus preventive services without cost sharing. Preventive care services include recommended immunizations. During the COVID-19 public health emergency, this coverage

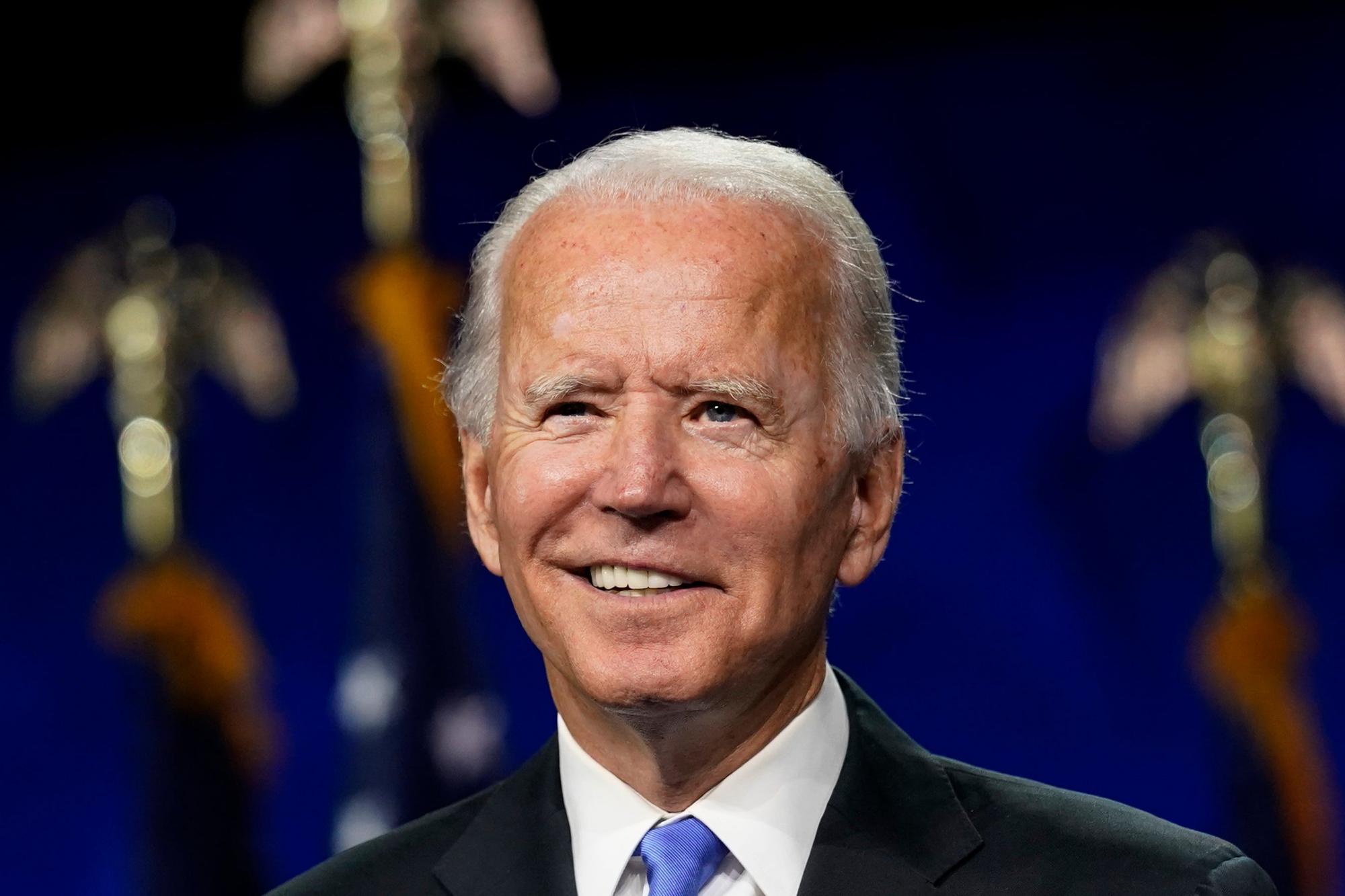

How a Biden Administration Might Impact HR and the Workplace Each presidential transition brings changes to the HR landscape. When President Donald Trump took office in 2016, he overturned or

IRS Guidance The IRS letter responded to a letter from a Congressperson written on behalf of a constituent. Generally, the IRS cannot provide binding legal advice to taxpayers unless they

Important Dates Oct. 1, 2019 PCORI fees were scheduled to expire for plan or policy years ending on or after Oct. 1, 2019. 2020-2029 Fiscal Years PCORI fees now apply

Social Connectivity In the Time of COVID-19 The need for social distancing has put a pause on normal socializing activities, like family get-togethers, restaurant outings and music concerts. As the

Highlights In anticipation of when a COVID-19 vaccine is available, the interim final rule requires Medicare, Medicaid and private insurers to cover the vaccine without cost sharing. Coverage of qualifying

Important Dates January 1, 2022 Detailed pricing information must be made public for plan years beginning on or after Jan. 1, 2022. January 1, 2023 A list of 500 shoppable

Employee Benefit Plan Limits for 2021 Many employee benefits are subject to annual dollar limits that are periodically updated for inflation by the IRS. The following commonly offered employee benefits